Innovation Changes Everything... Motivation Puts It To Work.

Business Continuity = Success

In 1999 ORBIS established the Platinum Standard for Bank and Financial Institution operational security, confidential data transfer and management, and integration of strategic policies, resources, protocols and practices assuring most advantageous commerce continuity.

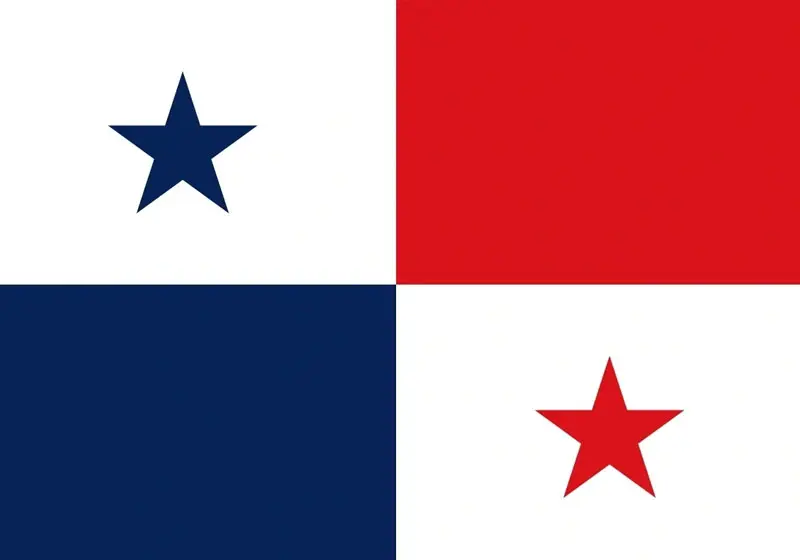

Our footprint is the Caribbean, with our corporate operations specifically located to facilitate rapid support response to our client community with close proximity redundant resources, and tactical client protective elements targeting confidential most advantageous cross-Caribe Banks integrations. We do this with structured functionality of multi-layered Business Continuity strategies facilitating client security and integrity in daily commerce, embedded with assets and resources to prevent, manage, contain and resolve dangerous, difficult and unpredictable events. Directed across an extensive spectrum of predictive contingencies, we cost-effectively construct plans, policies, procedures and assets to best assure our Client’s benefitting a safer today, and a stronger business tomorrow. Our sole performance consists of composite ways and means to proactively prevent internal/ incursion theft, loss and diversion, fraudulent schemes and criminal enterprises, tactical confidential data breach/ cyber access acquisition, Emergency operations and commerce Crisis Events and clandestine industrial espionage /subterfuge. Kidnap Ransom Negotiations and Recovery are part of our repertoire’.

It’s all about protecting business… your business. From without and within. From whatever.

ORBIS is entrusted directly supporting National Treasuries, International Banks and Financial Institutions spanning the Caribbean, comprising 489 Bank facilities, over 37,000 staff and more than 12 million of their customers. ORBIS is a member of CARICOM, the unified Caribbean Community and Commerce Market treaty and quietly designated by 15 member Countries as a geo-economic Financial Sector National Security Asset. The ORBIS Technologies Laboratory conducts ongoing research and development to adapt, integrate and utilize the most advanced technological resources in protective measures, devices and software to best apply them to “Client environment” proactive security advantage. We designed , developed and own, one of the most secure 2,048bit SSL Certified encrypted micro-burst data transfer/management programs in the World. Our designated Clients rely on and utilize it daily to transfer and manage their absolutely confidential transactions, client accounts data, intra-Bank communications and protocols. They rely on it, because they know they can…safely, confidentially, securely. We continuously improve it to prevent and defeat emerging threats, We are now advanced to AI version 4.2, and upgrading elements to make it even stronger.

ORBIS’ cadre of carefully acquired, effectively co-ordinated professionals ,architect integrated tactics ranging from simple, reliable redundancy and alternative performance protocols to ultra-sophisticated technologies, providing Clients versatile operational and cyber resilience based upon their perceived current, and probable potential, needs. Building commerce continuity upon productive structure assures their ability to fiscally breathe and grow. Correctly constructed and blended, our strategies and protocols provide our Clients with a secure, stable, robust performance business platform, with advantage of profitable ongoing Business Continuity.

This is what we do. And we are the most proficient in the Western Hemisphere in doing it. World Bank, International Monetary Fund, United Nations and INTERPOL all say so. We, and our Clients believe them.

You can too.

Geo-Economics Drives the Caribbean

In the mid-1990’s the US suffered a collapse of over 1,600 small Banks due to energy investment economics, and onerous Government business regulation. Small Banks borrowed from larger Banks to make loans for energy investing and related commerce. As small Banks failed “Trickle-Down” economics reversed as non-performing loans caused big Banks to collapse too. In the Caribbean, virtually ALL Banks were borrowing from US Banks and WorldBank to foster economic growth in commerce, industry, and Colonial infrastructure replacement. As the US money market cratered their economies collapsed, Treasuries failed, and inflation rocketed while Nations struggled. Commerce trailed behind leaving a cash vacuum. Public trust plummeted, mortgages and loans went unpaid, and Banks ate their incomes to forestall inevitable closure.

The Caribbean is a vital but vulnerable “Choke-Point” in Global Pacific rim commerce. ORBIS observed and analyzed the situation, recognizing the potential collapse of a vital economic market directly linked to the Pacific Rim industrial complex. We went to work to protect the Banking industry, and their far-reaching economic tentacles affecting virtually every commerce market, developing plans, procedures, strategies and resources to support long-term recovery to profitability.

Integrated Caribe Banking Resilience

Our first Bank client is still our client today, partnering with ORBIS as we are entrusted directly supporting National Treasuries, International and correspondent Banks, Mints and Repositories spanning the Caribbean, comprising hundreds of bank facilities, thousands of their staff and Millions of their customers. ORBIS is a member of CARICOM, the unified Caribbean Community and Market treaty alliance, and quietly designated by 15 member Countries as a Geo-Economic Financial Sector National Security Asset. We have corporate facilities in the US and Caribe Countries, providing our Clients with a myriad of Business Resilience and Continuity products and services ranging from ultra-secure encrypted data management to financial services security, to Emergency / Disaster prevention, planning, mitigation and recovery, to proactive strategies targeting emerging fraud technologies, trends and criminal enterprises, counter-measures to prevent business disruption, protect personnel and assets, and assure their commerce cost-effectively proceeds profitably. We have extensive expertise in a cadre of staff and resources including a Bank Document security Laboratory, a Bank data encrypted and financial services support Cloud Server Satellite asset, and a Threat/Risk Assessment facility constantly monitoring, assessing and evaluating potential Emergency/ Disaster incidents, events and emerging theft/loss trends and schemes. ORBIS also manages Crisis Critical Event response and recovery assets Regionally placed across the Caribbean to strategically facilitate rapid response to Emergency events, assuring Bank commerce losses are mitigated, operations are functional and business continuity recovery rapidly accelerates as profitable sustained whole business operations.

This is what we do. And, we are the most proficient in the Western Hemisphere at doing it.

WorldBank, International Monetary Fund, United Nations, and INTERPOL all say so.

We, and our Clients…believe them. You probably should, too.